Dino Polska S.A (DNP.WA)

I’m not a professional and I’m not recommending anything. Just sharing my thoughts. Dino Polska analysis

General:

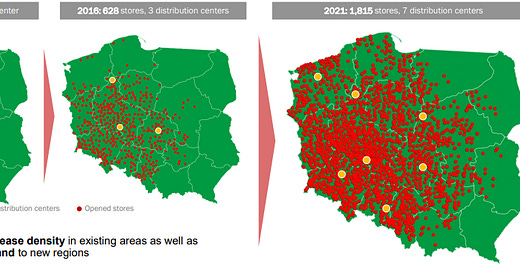

Dino Polska is a company founded 1999 by Tomasz Biernacki with a goal of running medium-sized supermarkets in rural areas (400 square-meters with 5000 stock-keeping-units). Today they operate 7 distribution centers and 1850 stores around Poland, mainly in the northern and western part of the country in small places with around 2 500 inhabitants within a radius of 2km from where most people live.

Dino Polska buy their own land, and then let a building company also founded by Thomasz Biernacki build the stores. This company sole purpose is to build Dino Polska stores wich makes the building process much faster. Thomasz is no longer the CEO of Dino Polska, however he owns 51% and is a chairman of the company. The company is now run by CFO, Michal Kruz and COO, Izabela Biadala together both of wich have been in the company since 2002 wich different positions within the company.

Poland:

We can’t either forget about Polands economic growth the last 30 years. Between 1990 and 2015, Poland was the country in Europe with the highest GDP per capita growth with 7.3x and also with a resilient population with good working moral and high level of education. Poland could be a future powerhouse in Europe. Year 2015 in eastern Europe, a cooperative was started called “Three seas initiative”, this group is aiming on improving relations, trade and development between the including countries Austria, Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia and Slovenia. This could potentially give Dino Polska more markets to expand too if the polish market is fully covered.

However, like always Poland is in risk from aggression from Russia, Belarus or being in the middle of a west vs east problems.

Competition:

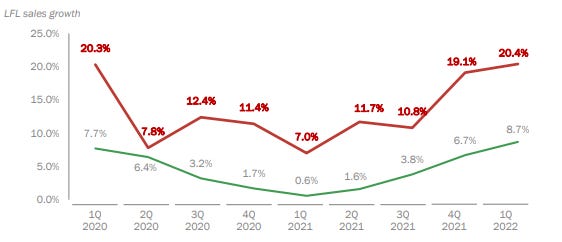

Biggest competitor is Biedronka with a 24% market share. It’s owned by portuguese Jeronimo Martins and is running most of its operations in Poland. Biedronka have more stores, higher revenue and more capital but the revenue growth is currently fading. ROIC at 15% and revenue CAGR of 6,8% last 6 years compared to Dino Polskas ROIC at 20% and revenue CAGR of 25%. EBITDA margins at 5.9% for Biedronka and Dino Polska at 8.5%.

Maybe not weird due to the size of Biedronka in comparison. With a 14M EUR revenue vs 3M EUR for Dino Polska. However, they are not really targeting the same audience, as mentioned Dino Polska is for rural areas. Biedronka is targeting bigger cities. Technology-wise, Biedronka have come further with self-checkout desks.

Financials:

Dino Polska have total debts at 1,5B PLN, with short term debts reaching up to 488M PLN. Cash&bank is at 418M wich means that dealing with debt payments should not be a problem. EBIT to debt sits at low 0,35-0,65 last 5 years. Interest costs is also low with a interest coverage ratio at 0,04. Worth mentioneing that Dino Polska is a company with good reputation among investors and asking for money or issuing bonds would bring in the capital needed in case they would need it. Just take a look at ROIC as previosly mentioned. I would like to see the current ratio above 1, currently sits at 0.7 but it should be OK. Debts are no issue.

Cash conversion rate is also negative at -33. That means that the company receives money before they have even paid for the goods, giving alot of financial flexibility in normal times but also in times with rising inflation. You can also see how they manage this through the LFL-sales (Like-for-like)

The free cash flow have been negative the last few years. Low margins, negative FCF have been accepted by investors though due to the high revenue growth. Dino Polska is still in their growing phase.

Valuation:

Market cap currently sits at 36B PLN (367PLN per share) with a P/E of 40. Personally I don’t think it is overvalued. The price is driven by lack of alternatives on the polish stock market now when we are heading to tougher times. Not many companies have such strong fundamentals with also a very strong growth. Dino Polska will grow into their valuation if they continue like this and will continue to be bought at high multiples at around x15-x20 going forward. Seeing it go to 600PLN sometimes in a not to far future. We can’t forget that the land bought 20 years ago might also be understated on the blance sheet aswell.

Catalyst:

GDP per capita growth in Poland continues

Expansion in within Poland but also further to the east.